The increasing inequality in income and wealth in recent years, together with excessive pay packages of CEOs in the U.S. and abroad, is of growing concern, especially to policy makers. Income inequality was identified as the #1 Top 10 Challenging Trends at the 2015 World Economic Forum annual meeting in Davos last January. Columbia Engineering Professor Venkat Venkatasubramanian has led a study that examines income inequality through a new approach: he proposes that the fairest inequality of income is a lognormal distribution (a method of characterizing data patterns in probability and statistics) under ideal conditions, and that an ideal free market can “discover” this in practice.

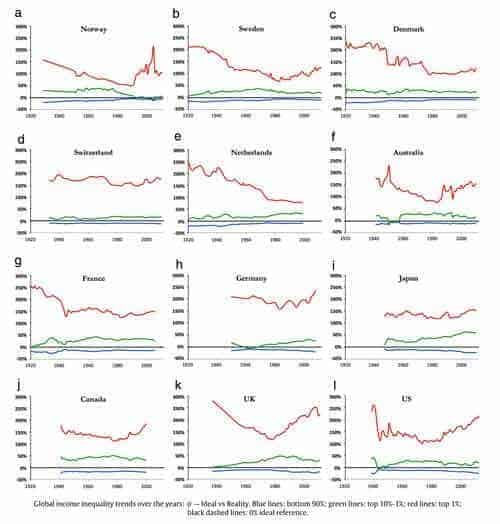

Venkatasubramanian’s analysis found that the Scandinavian countries and, to a lesser extent, Switzerland, Netherlands, and Australia have managed, in practice, to get close to the ideal distribution for the bottom 99% of the population, while the U.S. and U.K. remain less fair at the other extreme. Other European countries such as France and Germany, and Japan and Canada, are in the middle. The paper, “How much inequality in income is fair? A microeconomic game theoretic perspective,” was coauthored by Jay Sethuraman, professor of industrial engineering and operations research at Columbia Engineering, and Yu Luo, a chemical engineering PhD student working with Venkatasubramanian, and published online in the April 28th issue of the journal Physica A.

Venkatasubramanian, who is the Samuel Ruben-Peter G. Viele Professor of Engineering, Department of Chemical Engineering, and co-director of the Center for the Management of Systemic Risk, has long been interested in fairness and inequality and points out that the same concepts and mathematics used to solve problems in statistical thermodynamics and information theory can also be applied to economic issues. A key element in his work has been taking the concept of entropy, usually interpreted as a measure of disorder in thermodynamics and uncertainty in information theory, and applying it as a measure of fairness to economics.

“Our new theory shows, for the first time, a deep and direct connection between game theory and statistical mechanics through entropy,” says Venkatasubramanian. “This has led us to propose the fair market hypothesis, that the self-organizing dynamics of the ideal free market, i.e., Adam Smith’s ‘invisible hand,’ not only promotes efficiency but also maximizes fairness under the given constraints. By defining and identifying the ideal outcome, our theory can provide an intellectual framework that could be used to design macroeconomic policies to correct for such inequities.”

As an example of how his theory could be applied, Venkatasubramanian cites Switzerland, whose voters in November 2013 considered and rejected a referendum that would have capped the CEO pay ratio to 1:12. The number 12 was decided arbitrarily: Swiss activists felt that CEOs shouldn’t make more in a month than what their lowest employees made in a year. Using this new framework, policy makers can now examine this topic in a more analytical manner and develop guidelines based on fundamental principles of economic fairness rather than arbitrary limits.

While economists have known that the Scandinavian countries have a more fair distribution of income, especially when compared with the U.S., they have not known how close to the ideal distribution these countries are, Sethuraman observes, until now: “It is interesting that the economies that are generally perceived to have a fairer distribution of income are also those that are closer to the benchmark income distribution we have found with our new approach,” comments Sethuraman.

Venkatasubramanian has been pursuing a unified framework of game theory and statistical mechanics since he was a graduate student in 1983. This new work is the first to combine concepts from game theory, microeconomics, and statistical mechanics to address income inequality and the concept of fairness in an ideal free market environment. He uses entropy, which he says is a “wonderful concept that has been largely misunderstood and much maligned since its discovery 150 years ago,” as a bridge that links statistical mechanics and game theory.

“This unified framework of game theory and statistical mechanics, which I call statistical teleodynamics, offers us new insights about both disciplines and answers some long-standing open questions in economics and game theory,” he explains. “Economists have long wondered what it is that Adam Smith’s `invisible hand’ is supposed to be maximizing and what are the firms trying to jointly maximize in potential game theory. Our theory suggests that what the participants are jointly maximizing is fairness.”

Venkatasubramanian and Sethuraman plan next to work with economists to conduct more comprehensive studies of pay distributions in various organizations, and income distributions in different countries, in order to understand in greater detail deviations from ideal conditions in the market place and improve their model.

“As we all know, fairness is a fundamental economic principle that lies at the very foundation of the free market system,” Venkatasubramanian adds. “That’s why we have regulations and watchdog agencies that punish unfair practices such as monopolies, collusion, and insider trading to ensure the proper functioning of free markets. So it is reassuring to find that maximizing fairness collectively is the condition for achieving economic equilibrium and stability. I’m excited to have a theory of fairness for a free market economy that is analytical and quantitative, and makes testable predictions that can be verified with real-world data on income inequality.”

The problem is, big business doesn’t want to know about fair. Any time you try to explain fair pay wages to them, they tend to look at you like you are a criminal. Like you are the one trying to steal THEIR hard earned wages. They don’t think they are responsible for helping their employees live above the poverty line. Putting it into numbers, just means they are going to have to find a lobbyist smooth enough to dance around the facts to get what they want. They don’t want the government stepping in and telling them how much they should be paying someone. They bitch every time someone suggests minimum wage should be lifted a 50 cents. They’d rather spend the money on every lobbyist on the planet to avoid that, than pay someone that is actually working for them more fairly.