Summary: Since 2018, escalating tariffs between the US and China have dramatically altered trade patterns, with Chinese goods dropping from 21.6% to 14% of US imports by 2023. However, new research reveals that despite reduced direct imports, US dependence on Chinese products has actually increased when measured by value-added imports.

China Economic Quarterly International, September 2024, DOI: 10.1016/j.ceqi.2024.09.003 | Reading time: 4 minutes

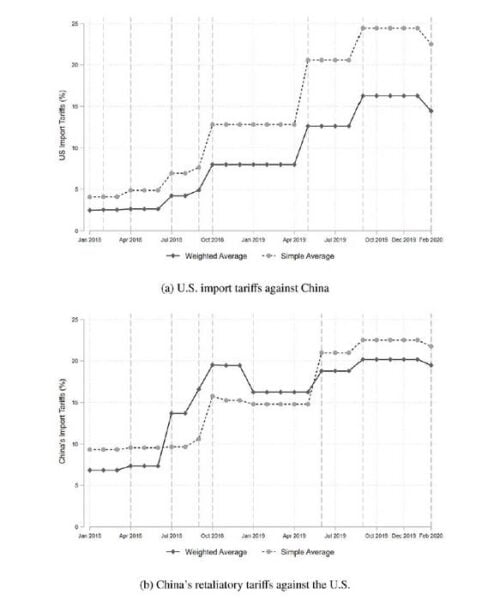

What began as a series of tariff increases has evolved into a complex reshaping of global trade patterns. Between 2018 and 2019, the United States initiated seven rounds of tariffs against China, triggering retaliatory measures that transformed the economic relationship between the world’s two largest economies.

The Tariff Escalation

The scale of these changes was dramatic. US tariffs on Chinese imports soared from 4.07% to 24.43%, while Chinese tariffs on US goods jumped from 9.32% to 22.53%. These increases led to a significant decline in direct trade between the two nations.

However, the impact hasn’t matched expectations. “The additional tariffs imposed by the US on China have neither effectively addressed trade imbalances nor brought manufacturing jobs back onshore,” notes Hong Ma from Tsinghua University.

Surprising Supply Chain Shifts

One of the study’s most striking findings concerns supply chain dynamics. “The ongoing trade tensions between China and the US have revealed vulnerabilities in the global supply chain and intensified the trend toward regionalized production networks,” explains Jingxin Ning from University of International Business and Economics.

Despite China’s declining share of direct US imports, American dependence on Chinese products has actually increased when measured by value-added imports. This suggests that trade barriers have merely rerouted, rather than reduced, economic interdependence.

Looking Ahead

The research emphasizes that unilateral trade policies have limited effectiveness in addressing complex economic challenges. Future solutions may require a more balanced approach that considers economic growth, fair distribution, and political stability alongside trade policy.

Glossary of Terms

- Value-added imports: Products counting the contribution of each country in the production chain

- Trade imbalance: Difference between a country’s imports and exports

- Supply chain: Network between a company and its suppliers to produce and distribute products

- Tariffs: Taxes imposed on imported goods and services

Test Your Knowledge

What was China’s peak share of US imports in 2017?

21.6%

How many rounds of tariffs did the US impose on China between 2018-2019?

Seven rounds

What was the US tariff rate on Chinese imports by December 2019?

24.43%

What was China’s share of US imports by 2023?

14%

Enjoy this story? Get our newsletter! https://scienceblog.substack.com/