Massive Study Uncovers Health Impacts of Market Fluctuations

A large-scale study examining over 12 million deaths in China has uncovered a significant link between stock market volatility and increased health risks. The research, published in Engineering, reveals that both rises and falls in the stock market correlate with higher rates of major adverse cardiovascular events (MACEs) and suicide.

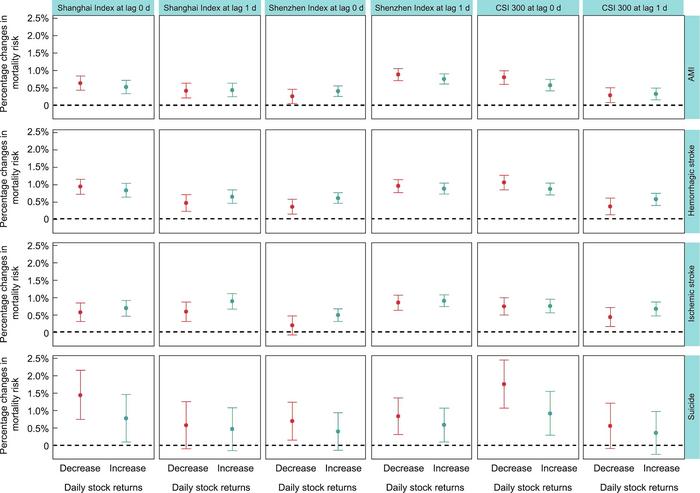

Analyzing data from 2013 to 2019, researchers found that a 1% decrease in daily stock returns corresponded to a 0.74%–1.04% increase in MACE-related deaths and a 1.77% rise in suicides. Unexpectedly, market gains also showed negative health impacts, with a 1% increase in daily returns linked to a 0.57%–0.85% uptick in mortality risks.

These findings highlight the far-reaching consequences of financial market volatility on public health, extending beyond purely economic concerns.

Demographic Variations in Risk

The research team identified specific groups more vulnerable to the health impacts of stock market turbulence. Men, individuals aged 65-74, and those with lower education levels exhibited the highest risk increases.

“Our research demonstrates that the psychological stress induced by stock market volatility has severe and immediate health implications,” said Dr. Haidong Kan, one of the study’s authors. “This is not just a financial issue, but a serious public health concern that demands attention.”

The study employed an individual-level time-stratified case-crossover design, allowing for nuanced analysis of how daily stock volatility impacts mortality risks. By examining daily returns and intra-daily oscillations across three major Chinese stock indices, the team established clear correlations between market movements and health outcomes.

Why it matters: This research underscores the profound connection between financial markets and public health. As stock markets continue to play a central role in the global economy, understanding and mitigating these health risks becomes increasingly important for individuals, healthcare systems, and society at large.

The results raise important questions about the mechanisms through which market volatility affects health. Experts suggest that stress-induced physiological changes, such as increased blood pressure and inflammation, likely play a role in elevating cardiovascular risks. For mental health impacts, the emotional toll of financial losses or gains may trigger or exacerbate existing psychological conditions.

Critics might argue that correlation doesn’t imply causation, and other factors could influence these health outcomes. However, the large scale of this study and its rigorous methodology provide strong evidence for a direct link between market volatility and health risks.

The study’s findings suggest a need for targeted health education and mental support, especially during periods of market instability. Government and public awareness campaigns could help mitigate the cardiovascular and mental health risks associated with stock market volatility.

Future research directions may include developing and testing interventions to mitigate these health risks, such as stress reduction techniques, financial literacy programs, and targeted health screenings for high-risk groups during periods of market instability.