In the high-stakes world of financial security, a new analytical review reveals how Graph Neural Networks (GNNs) are outperforming conventional fraud detection methods by mapping the hidden relationships between transactions, accounts, and behaviors. The comprehensive study, examining over 100 research papers, provides a unified framework that could reshape how banks, payment processors, and insurers protect consumers and businesses from increasingly sophisticated financial crimes.

The global cost of financial fraud continues to climb annually, eroding trust in payment systems and costing institutions billions. But according to researchers from Tongji University and the University of Technology Sydney, GNN technology offers a powerful new defense by analyzing the complex webs of connections that traditional algorithms miss.

How GNNs Expose Hidden Fraud Networks

Unlike conventional fraud detection systems that examine transactions in isolation, GNNs excel at identifying suspicious patterns across entire networks of accounts and behaviors. Think of traditional fraud detection as looking at individual trees, while GNNs can view and analyze the entire forest simultaneously.

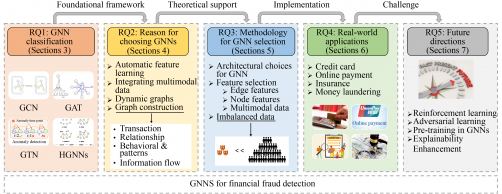

The review presents four primary types of GNNs with distinct approaches to fraud detection:

- Convolutional GNNs – Process transaction patterns similar to how image recognition works

- Attention-based GNNs – Focus computing power on the most suspicious connections

- Temporal GNNs – Track how transaction patterns evolve over time

- Heterogeneous GNNs – Analyze different types of connections simultaneously

Each approach offers unique advantages for specific fraud scenarios—from credit card theft to complex money laundering operations and insurance scams.

Real-World Applications Already Showing Results

The research highlights multiple real-world applications where GNNs are already demonstrating their effectiveness. The open-source AntiFraud project on GitHub represents one example of how these techniques are being deployed to protect financial systems.

But what makes these systems particularly valuable in today’s landscape? As fraud tactics grow more sophisticated, can our detection methods keep pace? The researchers believe GNNs provide a substantial advantage precisely because they mirror how modern fraud operates—through networks rather than isolated incidents.

Benefits Across the Financial Ecosystem

The review outlines specific advantages for different stakeholders in the financial system:

For financial institutions, integrating GNN modules into existing fraud detection pipelines can significantly improve accuracy while reducing false positives—those frustrating instances when legitimate transactions are flagged as suspicious. This enhancement not only reduces operational costs but also improves customer satisfaction.

Policymakers and regulators can leverage GNN-driven analytics to develop more effective data-sharing regulations and transparency standards. This balance between security and privacy represents one of the most critical challenges in modern financial oversight.

For the research community, the review maps out key challenges that will shape future innovations, including improved scalability, better interpretability of results, and adaptability to evolving fraud tactics.

Challenges Remain Despite Promise

Despite their potential, GNNs face several implementation hurdles. The computational resources required to process large transaction graphs can be substantial, potentially limiting real-time applications. Additionally, explaining how GNN models arrive at their conclusions—a crucial consideration for regulatory compliance—remains technically challenging.

Perhaps most significantly, fraud tactics constantly evolve, requiring continuous updates to detection systems. As the researchers note, the arms race between fraudsters and detection systems shows no signs of slowing.

Building Better Fraud Graphs

The review provides practical guidance for constructing financial graphs—the foundation of GNN analysis—including transaction graphs, relationship graphs, behavioral graphs, and information-flow graphs. Each type captures different aspects of financial activities, allowing for more comprehensive fraud detection.

Feature engineering—the process of selecting which data points to include in analysis—emerges as a critical factor in GNN effectiveness. The researchers outline best practices that balance complexity with performance.

Future Directions and Implications

Looking ahead, the integration of scalable and interpretable GNN solutions appears crucial for protecting financial systems and rebuilding public trust. The authors advocate for increased collaboration between academic researchers, industry practitioners, and financial regulators to advance GNN applications.

As digital transactions continue to dominate global commerce, the stakes for effective fraud detection grow higher. GNNs represent a promising approach to addressing this challenge by learning subtle patterns that traditional models often overlook.

The complete study is accessible via DOI: 10.1007/s11704-024-40474-y in Frontiers of Computer Science (Volume 19, 199609, 2025).

If our reporting has informed or inspired you, please consider making a donation. Every contribution, no matter the size, empowers us to continue delivering accurate, engaging, and trustworthy science and medical news. Independent journalism requires time, effort, and resources—your support ensures we can keep uncovering the stories that matter most to you.

Join us in making knowledge accessible and impactful. Thank you for standing with us!