Some of the boldest promises to fight climate change today are coming not from governments but the private sector. Major firms around the world are stepping forward with pledges to achieve “net-zero emissions” of carbon by a certain date, often 2050.

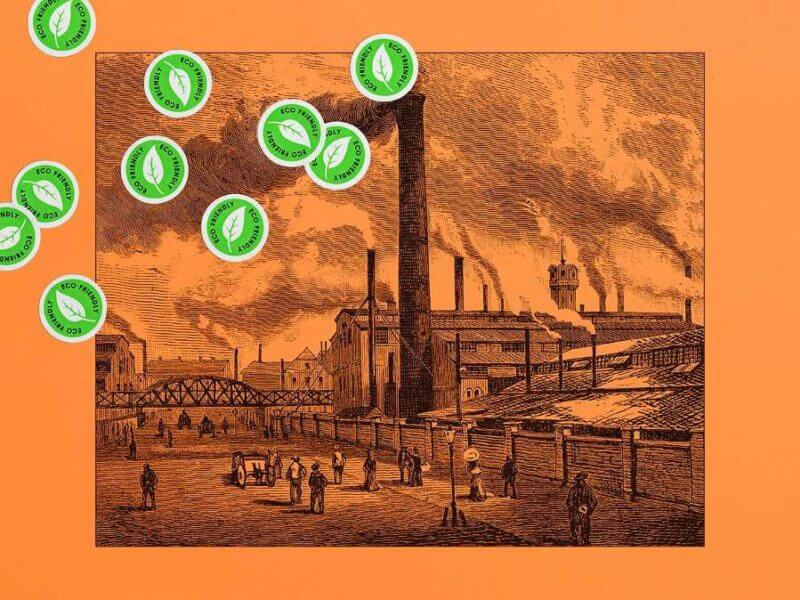

Of course, these announcements are played for all the PR juice they’re worth. And that’s fine — if they’re backed up with real action. But how do we know whether those pledges are meaningful or just greenwashing?

Stefan Reichelstein, professor emeritus of accounting at Stanford Graduate School of Business, has some answers. Reichelstein studies corporate carbon reporting and decarbonization efforts and is a leading policy adviser in the U.S. and Europe. In a chapter in the new book Frontiers of Social Innovation, written with Stephen Comello, director of the Energy Business Innovations focus area at Stanford GSB, and Julia Reichelsteinopen in new window, MBA ’20, he proposes a framework to make the distinction between corporate spin and real impact.

To start with, he says, you need to understand what’s being promised. Despite how it sounds, few firms plan to stop emitting greenhouse gases altogether. The idea of “net-zero” is that any future emissions will be zeroed out, in an accounting sense, by an equal amount of carbon offsets. Basically, for every ton of carbon dioxide a firm puts in the air, it can pay someone else to cut their emissions by a ton — or otherwise reduce atmospheric CO2 by that amount.

But offsets vary wildly in quality. You can, for instance, get an offset by paying someone to replant a forest as a carbon sink. That’s pretty solid. You can also, for a much lower price, pay a timber company not to cut down a forest in a given year. You can see how these “avoidance” offsets might become a racket, with trees being treated as hostages.

That’s just one of many ways in which net-zero plans, for all their good intentions, can end up looking like an elaborate shell game. Reichelstein recently talked about corporate carbon pledges and what can be done to steer these efforts in the right direction.

Did you anticipate that so many companies — accounting already for a sizable share of global economic activity — would voluntarily pledge to decarbonize?

I must say I didn’t expect it to happen this fast at this scale. There were a few ringleaders. Some of the early ones, interestingly, were European oil and gas companies, like BP and Total. And then some U.S. tech firms were early converts. But once it caught on, I think there was a “shaming” effect. The press reported that some progressive firms were taking climate change seriously and saying, “We’re going to do our part; this is our social responsibility.” And then others thought, “Oh, we need to say something too!” You don’t want to be the last one on the bandwagon. I think by now it’s several hundred global corporations that have made such pledges.

So the bandwagon is fueled by peer pressure?

That’s part of it. Institutional investors have had a real impact too. BlackRock came out and said it would only invest in companies that have a strategy for addressing climate change. So if you don’t, you could get dropped by these big institutional investors and face higher capital costs. And, really, firms must know that, eventually, government policies will require them to decarbonize anyway. It’s inevitable. So if I see carbon taxes coming down the road, I know it’ll be cheaper for me to get a head start and do this on my own. In other words, it’s not just about having a green image. By fulfilling my pledge, I’m also doing what’s in my own business interest.

But is “net-zero” the right goal? It seems like carbon-heavy industries can keep doing business as usual and then buy indulgences to pretend they have no emissions.

Some industries, like steel, cement, chemicals, and aviation, will be much harder to decarbonize. That’s just a reality. I think we should allow reduction efforts to move to where there is lower-hanging fruit, and allowing the sale of offsets, in theory, should do that. It also creates incentives for innovation. We now have startups developing technologies to suck carbon dioxide out of the air and sequester it underground. Direct air capture has a long way to go before it’s economically viable, but without a market for offsets, that’s not even a potential business.

So in principle, the idea of using offsets to zero out your emissions is sound?

In principle, yes! The problem is that the market is totally unregulated. It’s like the Wild West, where anything goes. The Economist reported that the average price for these offsets is $3 per ton of CO2. That shows how worthless a lot of them are. Believe me, you can’t really eliminate a ton of carbon for $3. And you start to see ridiculous claims. If you go to a Shell gas station in the Netherlands, you can now get “carbon-neutral” gasoline. How does that work? The answer is offsets. So people fill up their cars and think, “Wonderful. I’m not harming the climate.”

You talk about issues with “avoidance offsets.” Can you give an example of that?

Suppose a landowner says they’re going to burn down a forest for grazing land. They come to you and say, “I’m standing here with the match. If you pay me, I won’t light it. [Laughs] You want to pay?” So those emissions were avoided because of your interference — maybe! How do you know the threat was real? See, it’s based on a hypothetical that can’t be proven. And by the way, even if you did save the forest this year, there’s nothing to stop that guy from burning it down next year or burning a different forest in the meantime. By contrast, paying to capture carbon dioxide and sequester it underground — what we call a “removal offset” — is pretty permanent.

How can we tell which companies are making a good-faith effort, and which are just going through the motions?

There are two dimensions you need to look at. One is, what do they account for? Basically, how do you measure your carbon footprint? The other is, what are they actually pledging? It can’t just be a CEO saying, “We’re going to be carbon-neutral by 2050, and we’ll report back at that time. And by the way, I’ll be gone by then.” What we advocate is that companies should set milestones for where they want to be 5 years down the road, 10 years, 15 years, all the way to 2050. So you’re not just setting a deadline, you’re mapping out a trajectory and explaining what you’re going to do.

In other words, a structure that creates near-term accountability.

Exactly. And of course, it will need to be revised as you go. Technologies will change, costs will change, so you’re going to have to hit reset regularly. But there has to be feedback and accountability. I mean, companies know this. This is what we do in management accounting all the time, when we hold a department responsible for hitting certain targets and then compare the forecasts to the actuals. If you set unrealistic goals, you’re going to lose credibility.

So a crucial piece of this is measuring the company’s actual carbon emissions over time.

Absolutely. We argue, in fact, that all companies should be required to report their carbon emissions each year. That’s a necessary starting point for any serious effort to slow climate change. But there needs to be a consistent framework for measuring emissions. One big problem with these net-zero pledges today is that firms are using different methodologies and definitions, so the numbers are all mixed up. And there’s no way for policymakers to aggregate the corporate data to know how we’re doing at the macroeconomic level.

You’ve proposed such a framework, which you call the as the Intertemporal Corporate Carbon Reporting standard. And you argue for a core reporting metric called direct net emissions. What is that?

Right now there’s no agreement on how we even define a company’s carbon footprint. What do you include? There are basically three categories. The narrowest is what’s called Scope 1 emissions: That’s the direct emissions coming out of a firm’s chimneys and tailpipes. Then there’s Scope 2 emissions, which are associated with the electricity a company consumes. So if a utility is burning fossil fuels to generate electricity, you could say the firms that use that energy are responsible for the emissions. And finally, in Scope 3, you look up and down the supply chain and include all the emissions associated with the inputs you buy from suppliers, as well as emissions caused by the use of your products. So an automaker, for example, would have to include all the anticipated exhaust emissions from customers buying und utilizing its cars.

Don’t you need to count all of those to capture the full impact of a firm’s decisions? After all, a carmaker could choose to make electric vehicles instead.

Well, in fact, the international Greenhouse Gas Protocol says you should measure all of them. The problem is, you can’t. Scope 3 is generally the largest component — maybe 98% for an automaker — so it swamps everything else, and it’s impossible to measure. Just think about the upstream side: The complexity of the supply chain for a car is overwhelming. It would be real guesswork. A recent study tried to see whether the tech firms, who are considered exemplars in all this, were getting their Scope 3 emissions right, and the answer was, not even close. They captured maybe half of it.

And again, it means you can’t aggregate the numbers to see how we’re doing overall.

Right. As soon as you include Scope 2 and 3, you start double-counting everything, because one firm’s direct emissions are another firm’s indirect emissions. So I appreciate the impulse to be complete, but it’s impractical. It muddies the waters, and that’s the opposite of what you want if people are to take the numbers seriously. To get a hard, clean metric that is really comparable between companies and over time, I argue that, at the corporate entity level, we should just focus on direct emissions — Scope 1. That gives you the clearest picture of where the carbon is coming from and who needs to clean up their act.

I’m hearing a subtext of pragmatism here.

Look, we can’t fail on this. We need a system that is sufficiently simple and transparent, is easily implemented, is fair and consistent, and provides accountability. I’m interested in what’s doable.

Are there any companies who you think are doing a really good job on this?

We did case studies of seven major corporations — all of whom were using different metrics and methods, of course — and I was very impressed with Microsoft’s reporting. They acknowledge the quality issues with different kinds of offsets, and there’s a whole disclosure about the portfolio of offsets they bought, which I think is exemplary. I haven’t seen any other company be as careful and transparent on this issue. Microsoft is setting high goals for itself, to be carbon-negative by 2030, and they’re very explicit about how they plan to achieve that.

Bottom line, do you think these voluntary net-zero pledges can make a difference?

I’m hopeful. [Laughs] You have to be hopeful. Otherwise you don’t do the work.

If our reporting has informed or inspired you, please consider making a donation. Every contribution, no matter the size, empowers us to continue delivering accurate, engaging, and trustworthy science and medical news. Independent journalism requires time, effort, and resources—your support ensures we can keep uncovering the stories that matter most to you.

Join us in making knowledge accessible and impactful. Thank you for standing with us!